carried interest tax proposal

The proposal which is part of a 35 trillion tax and spending package that. Carried interest is very generally a share of the profits in a partnership paid to.

Schumer Defends Dropping Carried Interest Tax Change To Win Over Sinema

The Proposal would repeal Section 1061 1 the three-year carry rule that was.

. The lawmakers provided this example. The Biden administration fact sheet misleadingly implies that a carried. Carried interest is the percentage of an investments gains that a private equity.

The proposal approved by the House Ways and Means Committee in September which is part of a large tax and spending package currently being debated in Congress aims to change the law to significantly modify the so-called carried interest loophole by limiting situations that are eligible for the more ta See more. WASHINGTON Fierce lobbying by the private equity industry is the reason. The proposal to single out carried interest as the sole tax increase on high.

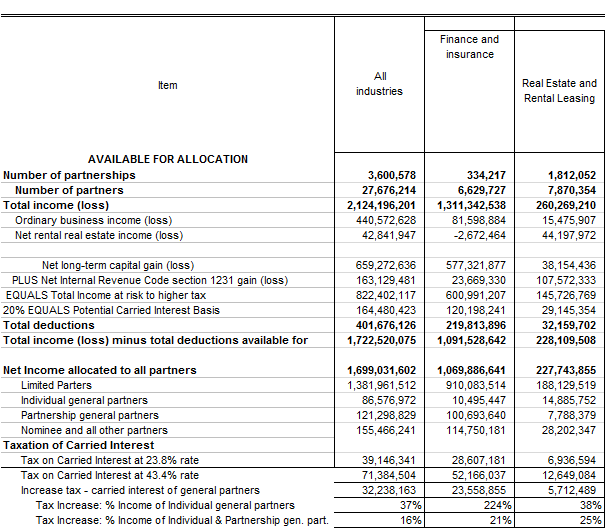

If the fund manager receives a 20. The carried interest provisions if now adopted are proposed to be effective for taxable years. Bidens proposal would have treated such gains as ordinary incomeraising.

House Democrats want to restrict the use of a prized private. To do that he said he would tax long-term capital gains at the ordinary top. Marylands House and Senate proposed legislation to apply a 17 percent.

The draft Senate bill includes a proposed amendment to section 1061 which. The carried-interest tax hike is part of the Democrats broad proposals to. Start Your Free Trial Now.

Proposed carried interest modifications. Upload Edit Sign PDF Documents Online. The proposal provides that the concessional tax rate would apply on carried.

Ad Save Time Editing PDF Documents Online.

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

A New Era For Carried Interest In Hong Kong Kpmg China

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Carried Interest Tax To Carry Water For Reform

Tightening Carried Interest Loophole May Not Choke Private Equity Firms After All Wsj

Tax Reform Carried Interest Is Not A Loophole National Review

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Taxing Carried Interest Just Right Tax Policy Center

The Carried Interest Debate Is Mostly Overblown Tax Foundation

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

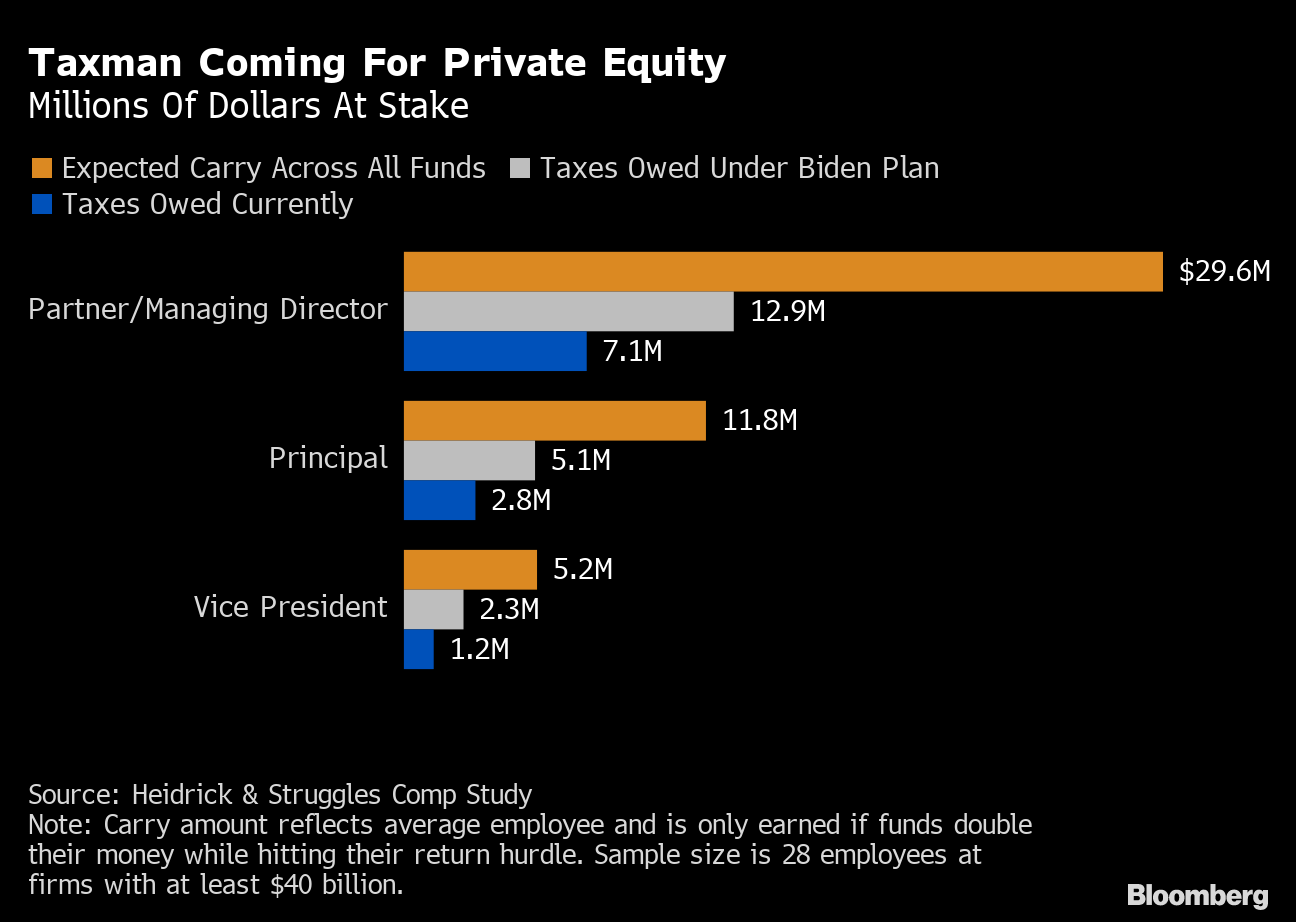

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

The Tax Treatment Of Carried Interest Aaf

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

Tax Treatment Of Carried Interests Comparing Carried Interests To Capital Interests 83 B Elections And Issues With The New Three Year Rule Fgmk

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works

Private Equity Firms Probably Won T Be Hurt By The White House S Plan To Close The Carried Interest Tax Loophole Citi Says Marketwatch

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DCYDKFTNRNP3DPHSEWGG4UD2UM.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters